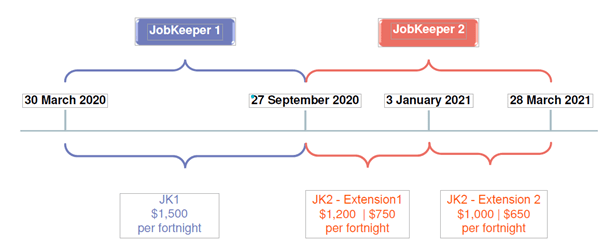

JobKeeper 1 is about to end on 27 September 2020.

To receive JobKeeper 2 from 28 September 2020, the business owners will need to re-assess their eligibility to obtain continuing support from the government.

There are two parts of JobKeeper 2:

- Extension 1 for the period between 28 September to 3 January 2021, and

- Extension 2 for the period between 4 January 2021 to 28 March 2021.

In this blog, we will focus on JobKeeper 2 support for small business areas.

What doesn’t change in JobKeeper 2?

- The turnover test remains the same at 30%.

- If you are already enrolled for JobKeeper 1, you do not need to re-enrol for JobKeeper 2.

- If you are already claiming for your employees for JobKeeper 1, you do not need to re-assess their eligibility or fill in a new Employee Nomination Form again.

- If you are claiming under Business Participant, you do not need to meet any further requirements in relation to basic eligibility test.

- You are still required to lodge a monthly declaration to the ATO reporting actual turnover and projected turnover.

- The same “One-In-All-In” rule applies, and you will require to do a top-up pay for an eligibility employee for the relevant pay period.

What will be changed in JobKeeper 2?

- The turnover test will be based on actual turnover, rather than projected turnover.

- The turnover tests need to be carried out separately for JobKeeper 2, Extension 1 and Extension 2.

- The payment rate will reduce and split into two tiers’ rate.

- You will need to make a choice of Tier 1 or Tier 2 rate when you submit your STP or make a monthly declaration to the ATO.

What’s the new turnover test in JobKeeper 2?

For businesses already enrolled in JobKeeper 1, to receive payments from 28 September 2020, you need to meet a decline in turnover test based on actual GST turnover.

Businesses that are enrolling for the first time, need to meet the Basic Eligibility Test and the decline in turnover test/s for the relevant period.

| JobKeeper 2 – Extension 1 | JobKeeper 2 – Extension 2 | |

| Decline in turnover test | Actual GST turnover in the September 2020 quarter fell by at least 30% compared to the same period in 2019.* | Actual GST turnover in the December 2020 quarter fell by at least 30% compared to the same period in 2019.* |

* Alternative tests may apply

Calculating GST Turnover

Most businesses will generally use their Business Activity Statement (BAS) reporting to assess eligibility. Entities that are registered for GST must use the same method that is used for GST reporting purposes. That is, if the entity is registered for GST on a cash basis then a cash basis needs to be used to calculate current GST turnover for the purpose of these new tests.

Current GST turnover includes:

- Proceeds from the sale of capital assets unless the sale is input taxed.

- Taxable supplies.

- GST-free supplies.

Current GST turnover excludes:

- Input taxed supplies such as residential rental income.

- Financial supplies such as dividends and interest.

- JobKeeper payments.

- ATO cash flow boost payments.

- State based grants.

What’s The Payment Rates in JobKeeper 2?

From 28 September 2020, the payment rate for JobKeeper will change from the flat rate of $1,500 and split into a higher (Tier 1) and lower rate (Tier 2), depending on the working hours in a reference period.

Reference periods and hours:

| Reference periods | Hours | |

| Eligible employees | The 28 days finishing on the last day of the last pay period that ended before either*: 1 March 2020, or1 July 2020. | Actual hours worked including any hours for which they received paid leave or paid absence for public holidays. An employee’s ‘actual’ hours might be different to their contracted, ordinary hours or hours they are paid for. |

| Eligible business participants | February 2020 (29 days)* | Active engagement in the business. |

* Alternative reference period may apply

Payment rates per eligible employee or business participant

| JobKeeper 2 | Extension 1 | Extension 2 |

| Reference period | 28 September to 3 January 2021 | 4 January 2021 to 28 March 2021 |

| Worked 80 hours or more | $1,200 per fortnight (Tier 1) | $1,000 per fortnight (Tier 1) |

| Worked less than 80 hours | $750 per fortnight (Tier 2) | $650 per fortnight (Tier 2) |

JobKeeper payment rates and timeline

What is the deadline for top-up payments?

For the JobKeeper fortnights starting 28 September 2020 and 12 October 2020 (Fortnight 14&15), the ATO is allowing employers until 31 October 2020 to make the top-up payments.

What happen if you are not currently GST registered or GST registered but only lodge annul GST return?

Entities that are not registered for GST or lodge Annual GST Return can choose whether to calculate GST turnover using a cash or accruals basis but must use a consistent method.

What if you don’t have a comparison period or there was a one-off event?

The Commissioner has the power to set out alternative tests that establish eligibility in specific circumstances where it is not appropriate to compare actual turnover in a quarter in 2020 with actual turnover in a quarter in 2019.

The Commissioner provided a number of alternative tests that could be used for passing the original decline in turnover test. The ATO has indicated that similar tests are likely to be available for the additional decline in turnover tests for the September 2020 and December 2020 quarters.

The alternative tests have not been released yet for the new decline in turnover tests. We will update the guide once these are released.

If your business is impacted by COVID-19, please contact us for assistance. It only takes less than half an hour and could save you thousands.

Contact Beyond Taxation for some help today on 1300 552 993 or email Joy@beyondtaxatin.com.au

General Advice Warning

The information contained in this communication has been provided as general advice only and was prepared while the information was available at the time of writing.